Table of Content

I have accelerated my weekly mortgage payment so the payment is different. So I adjusted number of weekly payments to get the right weekly payment amount. Its not perfect but it gives me a view of were I am going and more incentive to pay off the mortgage faster. As with many of our other calculators, this calculator will also solve for an unknown input. Make sure that there are no penalties for extra payments and paying off your mortgage earlier.

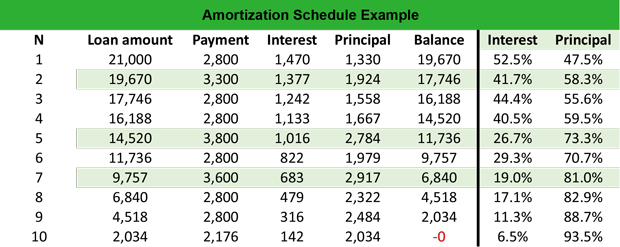

The above formula goes to E9, and then you copy it down the column. Due to the use of relative cell references, the formula adjusts correctly for each row. IPMT function - finds the interest part of each payment that goes toward interest. An amortizing loan is just a fancy way to define a loan that is paid back in installments throughout the entire term of the loan. All home lending products are subject to credit and property approval. Rates, program terms and conditions are subject to change without notice.

How Is An Amortization Schedule Calculated

In fact, our schedule is a simplified version of Microsoft's one , and both produce exactly the same results . I meant to say "Although the 30-year loan example has 360 monthly payments, with the FINAL payment in row 367 , the totals formulas in F2 and F3 only include up to row 360)". Any help on a loan with interest-only in the beginning, then switching to typical amortization at some point, would be much appreciated.

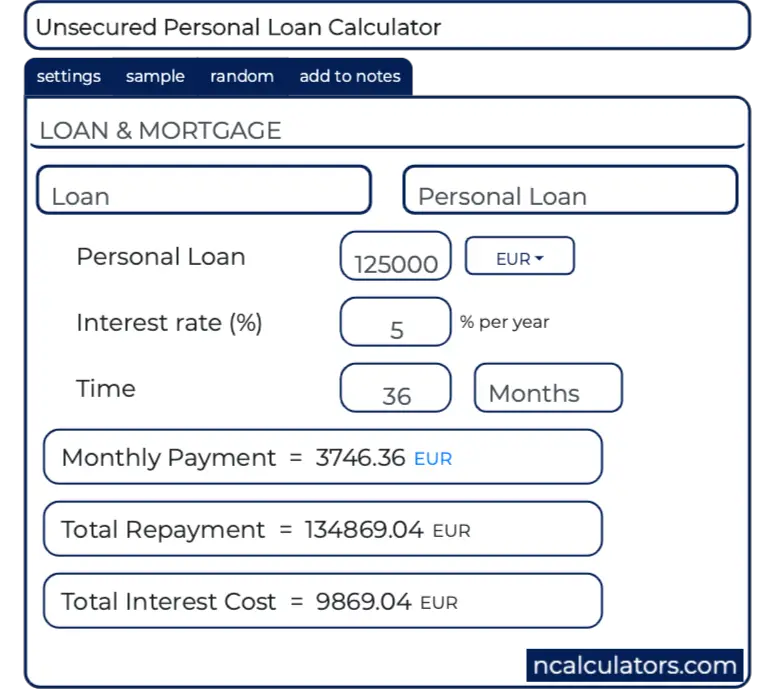

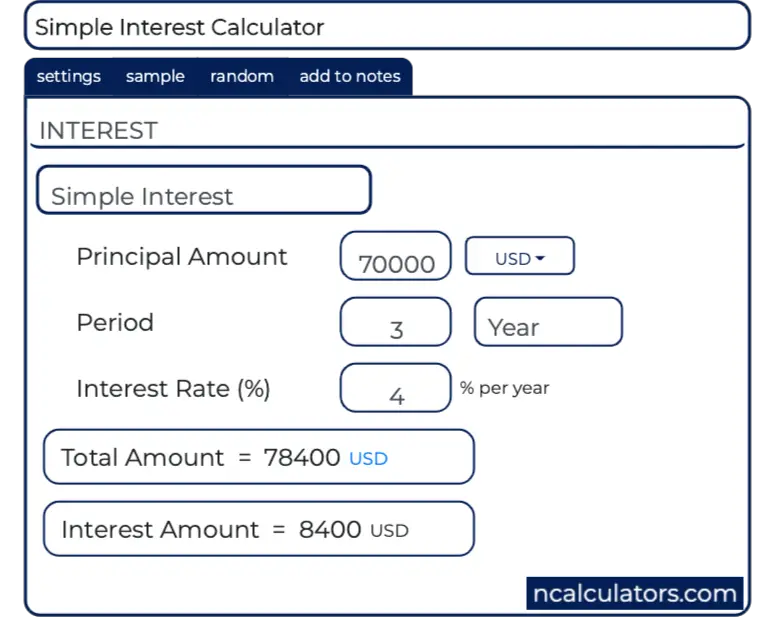

Fill out this calculator, including the additional amount and the number of times you will make that increased contribution each year. The calculation results will show how much interest you save & how much quicker your loan will be paid off. The tutorial shows how to build an amortization schedule in Excel to detail periodic payments on an amortizing loan or mortgage. However, lengthier loans help to boost the profit of the lending banks.

If you made your purchase, refresh to get started.

Determine how much extra you would need to pay every month to repay the full mortgage in, say, 22 years instead of 30 years. By default 30-yr fixed-rate loans are displayed in the table below. Filters enable you to change the loan amount, duration, or loan type. Use this amortization calculator to get an estimate of cost savings and more. Enter the annual interest rate for which you have agreed with the bank. An amortization schedule is like that friend who tells you that you have salad stuck between your two front teeth or that your fly is down.

If you have payments as positive numbers, remove the minus sign from the above formulas. If you can live with a bunch of superfluous period numbers displayed after the last payment, you can consider the work done and skip this step. If you strive for perfection, then hide all unused periods by making a conditional formatting rule that sets the font color to white for any rows after the last payment is made. All the arguments are the same as in the PMT formula, except the per argument that specifies the payment period.

Mistakes to avoid with extra payments

An amortization schedule shows how much money you pay in principal and interest. Make sure you earmark any additional principal payments to go specifically toward your mortgage principal. Lenders typically have this option online or have a process for earmarking checks for principal payments only.

In this example, Period 0 is in row 9 and Period 1 is in row 10. If your amortization table begins in a different row, please be sure to adjust the cell references accordingly. Please pay attention that we put a minus sign before the PMT function to have the result as a positive number. To prevent errors in case some of the input cells are empty, we enclose the PMT formula within the IFERROR function.

Amortization table can include special payments, depending on your requirements. If you have regular annual inflow of money and you want to include it in repayment, enter the value in “One-time yearly” row. Specify the month in which the amount should be taken in account. If you would like to add some extra money in every instalment, enter amount in “For each payment” row.

Loan approval is subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts. Interest rates and program terms are subject to change without notice. The shorter your loan term, the less total interest youll pay. Your credit score may or may not improve when you pay off a loan. When you pay your credit card debt or other loans on time, your credit score improves overall time.

Nper – multiply the number of years by the number of payment periods per year . Next, drag the Fill Handle icon to fill the rest of the cells in the column with the formula. How much principal and interest you paid over the life of the loan. Debt-to-income calculatorYour debt-to-income ratio helps determine if you would qualify for a mortgage.

To view the summary information about your loan at a glance, add a couple more formulas at the top of your amortization schedule. As the result, you have a correctly calculated amortization schedule and a bunch of empty rows with the period numbers after the loan is paid off. Rate - divide the annual interest rate by the number of payment periods per year ($C$2/$C$4).

No comments:

Post a Comment